NTPC Green Energy Share Price Target 2025 to 2030, IPO GMP, Allotment Status

As a part of NTPC Limited, NTPC Green Energy Limited (NGEL) is a significant player in India’s renewable energy landscape, dedicated to producing clean and sustainable power. With an emphasis on energy transformation, NGEL is advancing its initiatives to align with India’s goals for a greener, more sustainable future.

In this article, let’s explore NTPC Green Energy’s potential as it grows in India’s renewable energy space. We’ll cover share price targets from 2024 to 2030, key IPO details, and the company’s financial trends to give you a clear and easy-to-follow picture.

Table of Contents

- 1 Basic Details of NTPC Green Energy

- 2 About NTPC Green Energy’s Business

- 3 NTPC Green Energy IPO Details

- 4 Shareholder quota and record date

- 5 NTPC Green Energy ipo allotment status check

- 6 NTPC Green Energy Share Price Targets 2025 to 2030

- 7 NTPC Green Energy Share Price Target 2024

- 8 NTPC Green Energy Share Price Target 2025

- 9 NTPC Green Energy Share Price Target 2026

- 10 NTPC Green Energy Share Price Target 2027

- 11 NTPC Green Energy Share Price Target 2028

- 12 NTPC Green Energy Share Price Target 2029

- 13 NTPC Green Energy Share Price Target 2030

- 14 Financial Trends of NTPC Green Energy (In Crores)

- 15 Shareholding Pattern

- 16 Conclusion

Basic Details of NTPC Green Energy

| Company Name | NTPC Green Energy Limited |

| Business Sector | Power Generation & Distribution |

| Stock Symbol | NGEL |

| NSE Listing Status | unlisted |

| BSE Listing Status | unlisted |

| Official Website | https://ngel.in/ |

About NTPC Green Energy’s Business

NTPC Green Energy Limited operates within the renewable energy sector, primarily focusing on green power generation. With solar, wind, and hybrid energy projects across the country, NGEL aims to accelerate India’s transition to sustainable energy by reducing its carbon footprint.

This subsidiary of NTPC Limited is set to become a crucial part of India’s renewable energy goals, supporting projects and initiatives that focus on environmental sustainability.

- Ranked among the top 10 renewable energy players in India by operational capacity (as of June 30, 2024).

- Promoted by NTPC Limited, leveraging extensive project experience, strong supplier/off-taker ties, and financial strength.

- Renewable energy projects are primarily located in Rajasthan.

- Faces potential risks of cost overruns or delays in project construction.

NTPC Green Energy IPO Details

NTPC Green Energy’s IPO has gained attention as one of the largest upcoming IPOs in the power generation and distribution sector. Below are the essential details of the IPO:

| Offer Type | Mainboard |

| Market Cap | Large Cap |

| Sector | Power Generation & Distribution |

| Investor Types | Retail, HNI, Employee, Shareholder |

| Bid Price | ₹102.00 – ₹108.00 |

| Lot Size | 138 Shares |

| Retail Discount | ₹0.00 |

| Issue Size | ₹10,000.00 Crores |

| Offer Type | Mainboard |

| IPO Type | Book Building |

| Minimum Investment | ₹14,076.00 / 1 Lot |

| Maximum Investment | ₹1,93,752.00 / 13 Lots |

Important Dates

| Event | Date |

|---|---|

| Offer Starts | 19th November |

| Offer Ends | 22nd November |

| Allotment Date | 25th November |

| Listing Date | 27th November |

NTPC Green Energy Limited has announced a shareholder quota of 10%. The record date for this has been set as November 12, 2024. This means that investors holding shares of the company as of this date will be eligible for benefits under this quota.

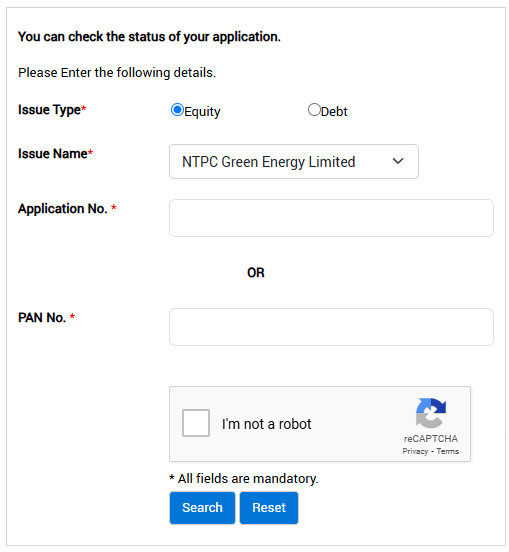

NTPC Green Energy ipo allotment status check

Checking your IPO allotment status is important to know if you’ve received shares or not. NTPC Green Energy’s IPO has been popular among investors, so finding out your result early helps you plan your next steps, whether it’s holding the shares or deciding your trading strategy.

To check the NTPC Green Energy IPO allotment status on the BSE website, follow these simple steps:

- Go to the Website: Open the BSE Application Status Page.

- Select Type: Choose “Equity” as the issue type.

- Pick the IPO: From the dropdown menu, select “NTPC Green Energy” as the issue name.

- Enter Details: Enter either your application number or PAN number. Make sure the details are correct.

- Check Status: Click on the “Search” button to see if you’ve been allotted shares.

NTPC Green Energy IPO GMP (Grey Market Premium)

The current GMP for NTPC Green Energy’s IPO is estimated at ₹4, indicating market enthusiasm and interest in the company’s listing potential.

Here are the share price targets for NTPC Green Energy for each year. These estimates are based on the company’s growth potential and the sector’s CAGR, which is expected to range between 9% (lowest) and 15% (highest).

| Year | High Approx |

|---|---|

| 2025 | ₹170 |

| 2026 | ₹200 |

| 2027 | ₹230 |

| 2028 | ₹260 |

| 2029 | ₹300 |

| 2030 | ₹350 |

In 2024, NTPC Green Energy is expected to witness growth as it establishes its position in the renewable energy sector. With favorable government policies supporting green energy and a robust IPO, the company’s share price is likely to gain traction.

| Year | Low Approx | High Approx |

|---|---|---|

| 2024 | ₹105 | ₹150 |

As NTPC Green Energy expands its green power initiatives in 2025, the share price could see additional growth. The company’s focus on solar and wind projects may attract increased investor interest, potentially boosting its market valuation.

| Year | Low Approx | High Approx |

|---|---|---|

| 2025 | ₹160 | ₹170 |

By 2026, NTPC Green Energy may benefit from both operational scale and economies of scale, helping the company improve its profit margins and financial stability.

| Year | Low Approx | High Approx |

|---|---|---|

| 2026 | ₹180 | ₹200 |

The year 2027 could see NTPC Green Energy further strengthening its market position, supported by investments in renewable energy infrastructure. The share price may reflect the company’s steady growth and increased capacity.

| Year | Low Approx | High Approx |

|---|---|---|

| 2027 | ₹190 | ₹230 |

With consistent revenue growth and solid financials, NTPC Green Energy’s share price is projected to continue rising in 2028. The company’s expansion into new renewable projects could support positive investor sentiment.

| Year | Low Approx | High Approx |

|---|---|---|

| 2028 | ₹210 | ₹260 |

NGEL is expected to maintain its growth trajectory in 2029. With the rising demand for clean energy, the company’s market value and share price are likely to benefit from this favorable trend.

| Year | Low Approx | High Approx |

|---|---|---|

| 2029 | ₹230 | ₹300 |

By 2030, NTPC Green Energy could be positioned as a leading renewable energy provider, achieving a milestone in its growth journey. The share price might see a peak as the company’s long-term strategies pay off.

| Year | Low Approx | High Approx |

|---|---|---|

| 2030 | ₹250 | ₹350 |

Financial Trends of NTPC Green Energy (In Crores)

| Year | FY’23 | FY’24 |

|---|---|---|

| Total Income | ₹170 | ₹2,037 |

| Profit After Tax (PAT) | ₹171 | ₹344 |

| Total Assets | ₹18,431 | ₹27,206 |

| Net Worth | ₹4,887 | ₹6,232 |

| Borrowings | ₹5,417 | ₹12,796 |

| Particulars | Pre-Issue | Post-Issue |

|---|---|---|

| Promoter & Promoters Group | 100.00% | 89.00% |

| Public | 0.00% | 11.00% |

| Total | 100% | 100% |

Conclusion

NTPC Green Energy’s IPO presents an opportunity for investors seeking to be part of India’s renewable energy growth. With strong backing from NTPC Limited, steady financials, and a clear vision for clean energy, NTPC Green Energy’s stock could show promising growth over the coming years.