Broadcom Stock Prediction 2025, 2026, 2027 to 2030

Broadcom Inc., one of the global leaders in semiconductor and infrastructure software solutions, has been a key player in the tech industry. Over the years, Broadcom has consistently delivered innovative products, driving revenue and market growth. Its strong position in the technology sector makes its stock highly valuable for long-term investors.

As we look toward the years from 2024 to 2030, Broadcom’s stock has shown significant potential due to its strong fundamentals, market expansion, and consistent performance. Below, we analyze its stock predictions for each year, along with detailed fundamental and technical analyses.

Table of Contents

- 1 Basic Details of Broadcom Stock

- 2 About Broadcom’s Business

- 3 Fundamental Data

- 4 Broadcom Stock Price Predictions 2025 to 2030

- 5 Broadcom Stock Prediction 2024

- 6 Broadcom Stock Prediction 2025

- 7 Broadcom Stock Prediction 2026

- 8 Broadcom Stock Prediction 2027

- 9 Stock Prediction 2028

- 10 Stock Prediction 2029

- 11 Broadcom Stock Prediction 2030

- 12 Technical Analysis

- 13 Broadcom Stock Quarterly Results

- 14 Conclusion

Basic Details of Broadcom Stock

| Company Name | Broadcom Inc. |

| Business Sector | Semiconductors and Software |

| Stock Symbol | AVGO |

| NYSE Listing Status | Listed |

| NASDAQ Listing Status | Listed |

| Official Website | www.broadcom.com |

About Broadcom’s Business

Broadcom Inc. is a leading provider of semiconductor and infrastructure software solutions. The company designs, develops, and supplies a broad range of products, including networking chips, broadband solutions, and enterprise software. Broadcom’s products cater to various industries, including data centers, wireless communication, and industrial applications. With a strong presence in global markets, Broadcom continues to drive innovation in technology.

Fundamental Data

- 📊 Market Cap: ₹1.05T

- 💰 Revenue: ₹51.574B

- 🏦 Net Income: ₹6.168B

- 📉 EPS (Earnings Per Share): ₹1.33

- 📅 Next Earnings Date: 27 Feb 2025

- 💵 Dividend (Yield): ₹2.12 (0.9%)

- 📈 Gross Profit Margin: 75.2%

- 🔢 P/E Ratio: 140.1x

- 💡 Return on Equity (ROE): 13.5%

- 📊 EBITDA: ₹25.659B

Broadcom Stock Price Predictions 2025 to 2030

Broadcom’s target prices are based on its growth in semiconductors, 5G, AI, and cloud computing. Strategic acquisitions and R&D investments will drive revenue. The estimated CAGR is 12% to 15%, reflecting strong growth in its hardware, software, and emerging tech markets.

| Year | High Approx |

|---|---|

| 2025 | $280 |

| 2026 | $310 |

| 2027 | $350 |

| 2028 | $370 |

| 2029 | $400 |

| 2030 | $450 |

Broadcom Stock Prediction 2024

In 2024, Broadcom’s stock is expected to experience strong growth due to increased demand for semiconductor products and advancements in 5G technology. The company’s investments in AI infrastructure and software will further drive its revenue. Broadcom’s strategic acquisitions will enhance its product portfolio, strengthening its competitive edge in the global market.

| Year | Low Approx | High Approx |

|---|---|---|

| 2024 | $180 | $250 |

Broadcom Stock Prediction 2025

The year 2025 is likely to witness accelerated growth for Broadcom, primarily driven by advancements in cloud computing and networking solutions. The expansion of its enterprise software division will play a crucial role in increasing revenue streams. By solidifying its presence in emerging technology markets, Broadcom will attract further investor interest and maintain upward stock momentum.

| Year | Low Approx | High Approx |

|---|---|---|

| 2025 | $220 | $280 |

Broadcom Stock Prediction 2026

In 2026, Broadcom is anticipated to benefit from its innovations in AI, IoT, and next-generation wireless technologies. The continuous rollout of digital transformation across industries will increase the adoption of Broadcom’s products, boosting sales and profitability. With a focus on R&D, the company will enhance its technological leadership.

| Year | Low Approx | High Approx |

|---|---|---|

| 2026 | $250 | $310 |

Broadcom Stock Prediction 2027

By 2027, Broadcom’s investments in cutting-edge wireless solutions and collaborations with major tech players will solidify its market position. The increasing need for advanced semiconductor chips across industries will drive revenue growth. Broadcom’s diversified business model will ensure steady performance during this period.

| Year | Low Approx | High Approx |

|---|---|---|

| 2027 | $270 | $350 |

Stock Prediction 2028

The year 2028 will likely see Broadcom expanding its revenue base through strong R&D capabilities and AI-powered technologies. Its entry into new global markets and diversification of product offerings will significantly improve its stock valuation. The growth of data centers and digital infrastructure will also contribute to its success.

| Year | Low Approx | High Approx |

|---|---|---|

| 2028 | $300 | $370 |

Stock Prediction 2029

In 2029, Broadcom’s leadership in the semiconductor and software sectors will drive substantial revenue growth. The company’s focus on maintaining strong financial health and delivering shareholder value will ensure investor confidence. Stable demand for its products will reflect positively on its stock performance.

| Year | Low Approx | High Approx |

|---|---|---|

| 2029 | $330 | $400 |

Broadcom Stock Prediction 2030

By 2030, Broadcom is projected to become a global leader in next-generation technology solutions. The company will play a significant role in driving digital transformation worldwide. Its robust financials, strong fundamentals, and consistent innovation will make Broadcom a preferred investment choice for long-term investors.

| Year | Low Approx | High Approx |

|---|---|---|

| 2030 | $350 | $450 |

Technical Analysis

Broadcom’s stock is in a strong uptrend but may face short-term corrections due to overbought signals. Traders should watch RSI and volume closely, while investors can view dips as buying opportunities.

- EMA & SMA: Price above 50-EMA and 200-EMA confirms uptrend.

- Support & Resistance: Support at $150–$160; resistance at $225–$230.

- RSI: Above 70, indicating overbought conditions.

- Volume: High volume supports bullish breakout.

- MACD: Buy signal as MACD is above the signal line.

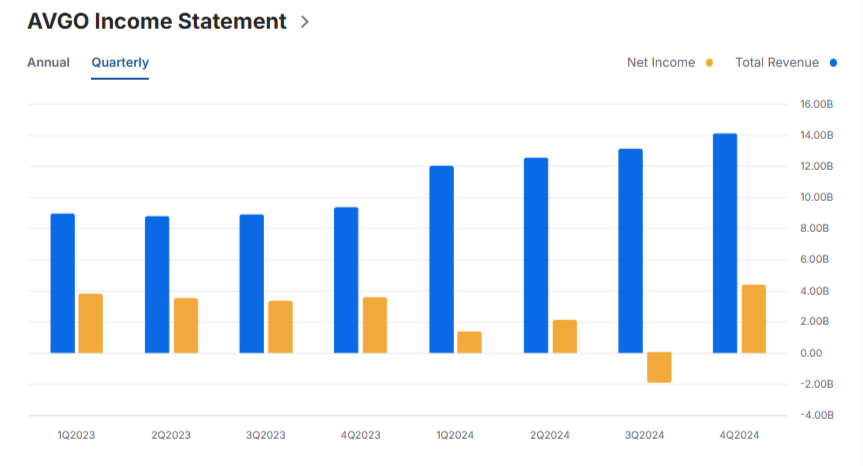

Broadcom Stock Quarterly Results

Conclusion

Broadcom Inc. continues to be a reliable investment for long-term growth, with significant potential from 2024 to 2030. Its leadership in the semiconductor and software sectors, combined with strong financial performance, positions it as a top choice for investors.